reverse tax calculator bc

Calculates the canada reverse sales taxes HST GST and PST. Originally called the Property Purchase Tax the PPT was first introduced in 1987 as a wealth tax to discourage speculation and cost 1 of the first 200000 and 2 of the remainder although 95 of home purchases did not qualify for the tax at the time as they were below the 200000 mark.

Sales Tax Canada Calculator On The App Store

This calculator should not be considered a substitute for professional accounting or legal advice.

. Who the supply is made to to learn about who may not pay the GSTHST. Here is how the total is calculated before sales tax. This is any monetary amount you receive as salary wages commissions bonuses tips gratuities and honoraria payments given for professional services This amount is either 18 of your earned income in the previous year or.

Due to rounding of the amount without sales tax it is possible that the method of reverse calculation charges does not give 001 to close the total of sales tax used in every businesses. The reverse calculator below takes into account all GST HST PST and QST for all the provinces in Canada. Updated Canada Sales Tax Calculator Pc Iphone Ipad App Mod Download 2021.

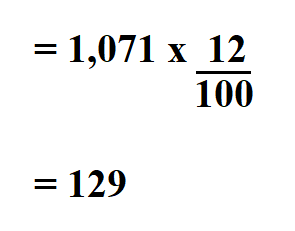

The rate you will charge depends on different factors see. Enter that total price into price including hst input. Formula for calculating reverse GST and PST in BC.

In Canada income tax is usually deducted from the gross monthly salary at source through a pay-as-you-earn PAYE system. Free online 2021 reverse sales tax calculator for Canadian Texas. Where the supply is made learn about the place of supply rules.

Reverse sales tax calculator bc. An error margin of 001 may appear in reverse calculator of Canada HST GST and PST sales tax. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax.

The following table provides the GST and HST provincial rates since July 1 2010. New Brunswick Newfoundland and Labrador Nova Scotia Ontario and Prince Edward Island. Harmonized Sales Tax HST The Harmonized Sales Tax or HST is a sales tax that is applied to most goods and services in a number of Canadian provinces.

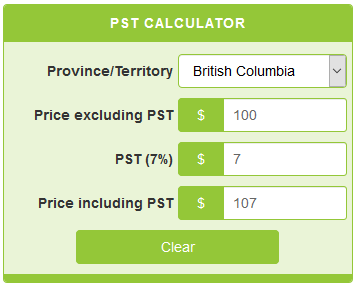

This simple PST calculator will help to calculate PST or reverse PST. Alberta British Columbia 5 GST British Columbia 12 Manitoba 5 GST Manitoba 12 New-Brunswick Newfoundland and Labrador 15 Northwest Territories Nova Scotia Nunavut Ontario Prince Edward Island Québec GST 5 Québec QST 9975 Québec QSTGST 14975 Saskatchewan 6 PST Saskatchewan 11 Yukon. Current Provincial Sales Tax PST rates are.

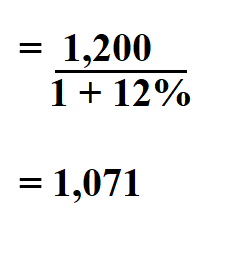

To calculate the total amount and sales taxes from a. Reverse Hst Calculator Hstcalculator Ca Following is the reverse sales tax formula on how to calculate reverse tax. Calculate GST with this simple and quick Canadian GST calculator.

Sales taxes also contribute to the Canadian governments budget. 2021 Income Tax Calculator Canada. These calculations are approximate and include the following non-refundable tax credits.

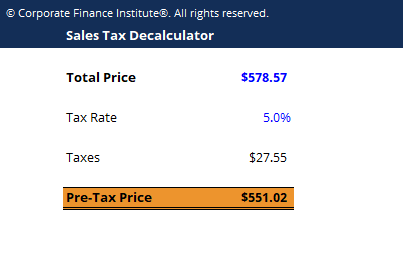

Tax Amount Original Cost - Original Cost 100100 GST or HST or PST Amount without Tax Amount with Taxes - Tax Amount. Calculates in both directions get totals from subtotals and reverse calculates subtotals from totals. The second tab lets you calculate the taxes from a grand total including tax and gives you the subtotal before tax.

And Federal tax brackets. It can be used as well to reverse calculate Goods and Services tax calculator. Lets calculate this value.

Reverse Sales Tax Formula. This free calculator is handy for determining sales taxes in canada. Amount without sales tax GST rate GST amount.

British Columbia is one of the provinces in Canada that charges separate 7 Provincial Sales Tax PST and 5 federal Goods and Services Tax GST. Amount without sales taxes x. Amount without sales tax QST rate QST amount.

If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase. When was GST introduced in Canada. It will work as a reverse GST calculator a reverse HST calculator a reverse GST PST calculator and even a reverse GST QST calculator.

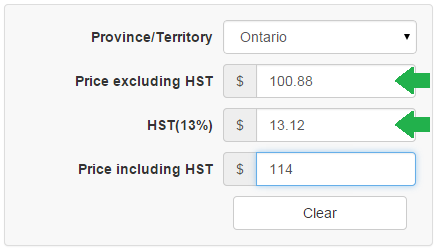

Below are instructions on how to use it. Amount without sales tax x HST rate100 Amount of HST in Ontario. Type of supply learn about what supplies are taxable or not.

In Québec it is called QST. Rates are up to date as of June 22 2021. The reverse sales tax calculator exactly as you see it above is 100 free for you to use.

What is GST rate in Canada. Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund. History of the Property Transfer Tax.

British Columbia Provincial. Reverse sales tax calculator remove tax. This reverse tax calculator will help you to know the purchasesell amount before and after tax apply.

Reverse Sales Tax Formula. Sales Tax Calculators Canada Reverse Sales Tax Calculator. It ranges from 13 in Ontario to 15 in other provinces and is composed of a provincial tax and a.

Most goods and services are charged both taxes with a number of exceptions. Why A Reverse Sales Tax Calculator is Useful. Amount with sales tax 1 GST and PST rate combined100 Amount without sales tax Amount with sales taxes x GST rate100 Amount of GST in BC.

Tax reverse calculation formula. After-tax income is your total income net of federal tax provincial tax and payroll tax. Look no further than this reverse tax calculator for Canadians.

The basic personal tax amount CPPQPP QPIP and EI premiums and the Canada employment amount. British Columbia Manitoba Québec and Saskatchewan. All harmonized sales tax calculators on this site can be used as well as reverse hst calculator.

On January 01 1991 goods and services tax GST was introduced in Australia. The BC homebuyer tax calculator application is a free service offered by the British Columbia Real Estate Association. Reverse GSTPST Calculator After Tax Amount.

British Columbia is one of the provinces in Canada that charges separate 7 Provincial Sales Tax PST and 5 federal Goods and Services Tax GST. It is easy to calculate GST inclusive and exclusive prices. Sales Taxes in British Columbia.

The information used to make the tax and exemption calculations is accurate as of January 30 2019. GSTPST Calculator Before Tax Amount. Margin of error for HST sales tax.

Useful for figuring out sales taxes if you sell products with tax included or if you want to extract tax amounts from grand totals. Only four Canadian provinces have PST Provincial Sales Tax.

Pin On Uber Driver Requirements

Question And Answer Time Part 1 The Greening Of Gavin Reverse Mortgage Question And Answer Computer Knowledge

Vat Refund For Expo 2020 Dubai In 2022 Expo 2020 Expo Vat In Uae

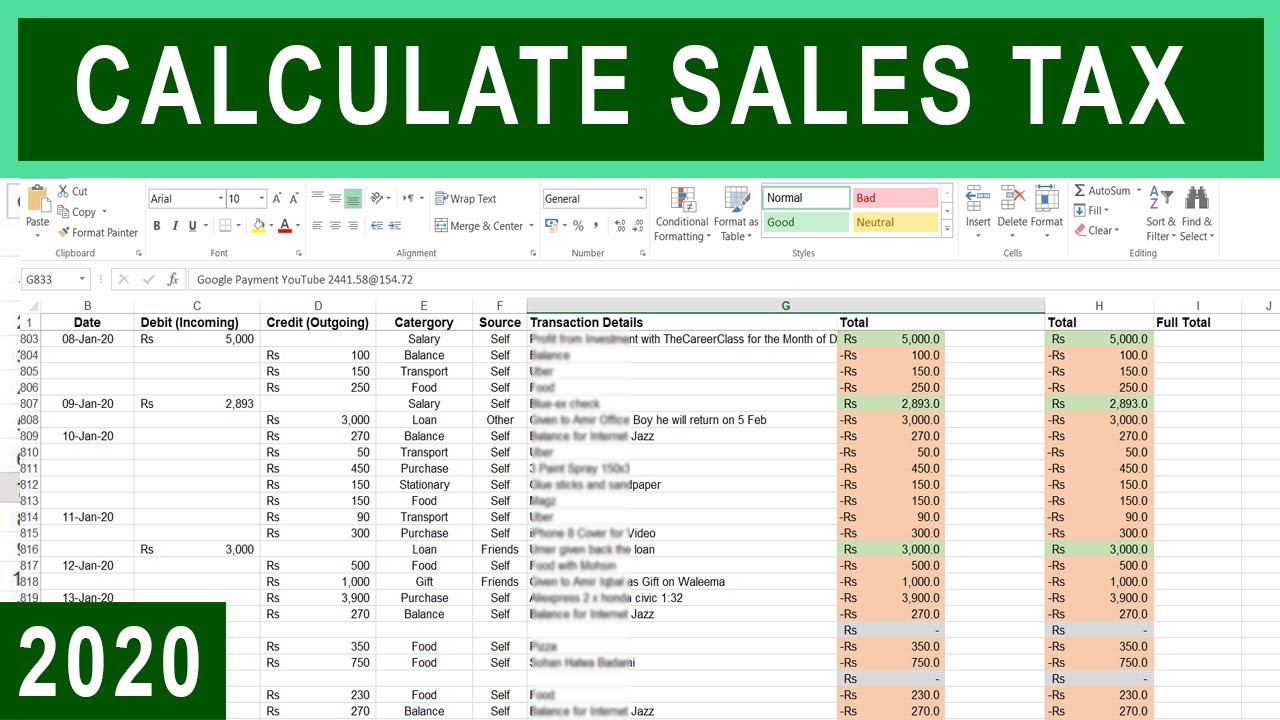

How To Calculate Sales Tax In Excel Tutorial Youtube

Sales Tax Calculation On General Journal Lines Finance Dynamics 365 Microsoft Docs

Reverse Hst Calculator Hstcalculator Ca

Infographic Mortgage Tax Benefit What S The Real Value Of Your Mortgage Real Estate Advice Real Estate Tips Mortgage Tips

Indian Gst Calculator Gstcalculator Net

How To Calculate Sales Tax Backwards From Total

Excel Formula For Reverse Tax Calculation Excel Formula Reverse Excel

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

Reverse Gst Hst Pst Qst Calculator 2022 All Provinces In Canada

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

How To Calculate Sales Tax Backwards From Total

Adding A Reverse Mortgage To Your Nest Egg Strategy Marketwatch Reverse Mortgage Mortgage Refinance Calculator Refinance Mortgage

Pst Calculator Calculatorscanada Ca

British Columbia Gst Calculator Gstcalculator Ca